[ad_1]

HONG KONG, CHINA – JUNE 05: A pedestrian walks by an electronic screen displaying the numbers for the Hang Seng Index on June 5, 2023 in Hong Kong, China. (Photo by Chen Yongnuo/China News Service/VCG via Getty Images)

China News Service | China News Service | Getty Images

Investors will now be able to trade selected Hong Kong stocks in both the Hong Kong dollar and Chinese yuan in the so-called dual counter scheme that launched Monday.

The newly launched “HKD-RMB Dual Counter Model” will see an initial 24 companies start offering yuan counters to allow investors in Hong Kong to trade in the yuan, in addition to the Hong Kong currency. Companies on the list include tech heavyweights like Tencent, Alibaba and Baidu.

The dual counter model covers securities listed in both Hong Kong dollar and renminbi counters only. The Hong Kong Exchange said all shares of the same securities in the two different trading counters will be “fully interchangeable between counters.”

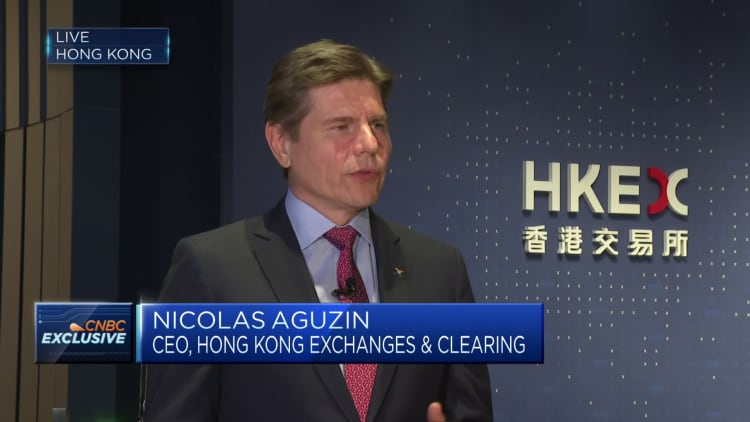

In an exclusive interview on CNBC’s “Squawk Box Asia,” Hong Kong Exchanges and Clearing CEO Nicolas Aguzin said the move was aimed at giving investors more options for investments, as well as more diversification possibilities.

“This program is aimed at number one, making sure that we give more options to investors. Number two, that we continue helping on the internationalization of the renminbi.” Thirdly, he said it “solidifies” Hong Kong’s role as a yuan trading hub.

The HKEX CEO noted that the initial batch of 24 companies make up about 40% of the average daily trading volume in the Hong Kong.

“We would expect that to continue expanding,” he added. “And over time, I think a great majority of the stocks in our markets will be participating in this program.”

With trading volumes in Hong Kong at a four year low, Aguzin said he expects an increase in turnover from the new dual connect model, noting there are “a lot” of yuan deposits in Hong Kong. As such, “you’re tapping a liquidity pool that is in renminbi that will now be able to invest directly,” he pointed out.

The key objective is to simplify the southbound flow of investments from the mainland, Aguzin said.

Investments from the mainland are currently carried out via the Southbound Stock Connect, which allows mainland investors to purchase Hong Kong stocks in Hong Kong dollars.

Stock Connect is a mutual market access program that allows investors in mainland China to trade and settle shares in Hong Kong via exchanges and clearing house in their home market, and vice versa.

Aguzin highlighted that it’s “very inconvenient for the mainland investors, [and] the fact that they will [now] be able to transact in an instant basis in renminbi, that’s a huge difference.”

He foresees more investment flow from the mainland, especially from retail investors.

“One of the challenges of Hong Kong is it’s only 7 million people. So it’s very limited in terms of retail. But the mainland, 1.4 billion people, that’s a lot. And a lot of that can come through Stock Connect and help liquidity in our market.”

The dual counter model will initially target the offerings at investors holding offshore yuan, and eventually, enable mainland investors to trade yuan stocks listed in Hong Kong using onshore yuan, Reuters reported.

While there is no firm date for when investments via Stock Connect will be able to access the dual counter model, Aguzin said this will take a little bit of time, and the HKEX is working closely with regulators and other stakeholders to make sure everything will be in place before making an announcement.

Not the first try

This is not the first time that such a scheme is being introduced in Hong Kong.

In 2012, the Hong Kong exchange launched a similar scheme called the “dual tranche, dual counter” model, which allowed the issuer to offer and list two tranches of shares in both the Hong Kong dollar and Chinese yuan.

As with today’s dual counter model, shares of both RMB tranche and the HKD tranche were of the same class, and shareholders under these two tranches are expected to be treated equally.

According to Bloomberg, that scheme failed to take off when only one company took it up.

The difference this time is that there is a “dual counter market maker program” — aimed at providing liquidity to the yuan counter and minimizing price discrepancies between the Hong Kong dollar and yuan counters.

Aguzin said there are currently nine of these market makers that have signed up, and he thinks this “should encourage a lot of activity and [make] sure that the markets are really stabilized in both markets.”

[ad_2]