[ad_1]

Billionaire Masayoshi Son, chairman and chief executive officer of SoftBank Group Corp., speaks in front of a screen displaying the ARM Holdings logo during a news conference in Tokyo on July 28, 2016.

Tomohiro Ohsumi | Bloomberg | Getty Images

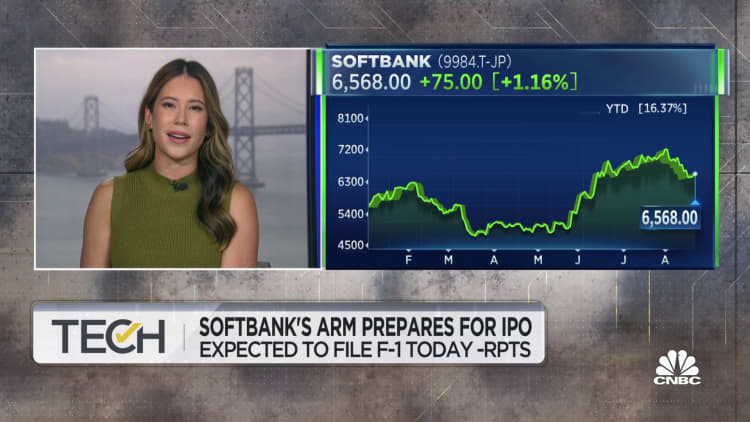

Arm, which is owned by SoftBank, is expected to file for its initial public offering as soon as Monday, according to reports. The firm’s stock market debut will be a major test for the IPO market, which has more or less closed off from new listings due to rising interest rates which have hammered appetite for risky assets in the last year or so.

Arm is one of the most important companies in technology. Its chip designs found in nearly all the world’s smartphones, including Apple iPhones and most Android devices. Its debut will be a big deal for an IPO market that’s been in the doldrums since 2022, but the company’s listing has big implications for SoftBank as well.

SoftBank has been attempting to bounce back from a grim tech market by reining in on its growth-focused investments and pivoting its focus to artificial intelligence, the hot topic of the hour in tech.

What is Arm?

Arm, which is headquartered in Cambridge, England, designed the architecture of chips found in 99% of all smartphones.

The company traces its history to an early computing company known as Acorn Computers. In 1990, Acorn spun out a new company named Advanced RISC Machines, structured as a joint venture between Acorn, Apple and U.S. chipmaker VLSI Technology.

Arm isn’t a chipmaker itself. Rather, the company is responsible for coming up with the “architectures” — or overall designs, including components and programming language instructions that other companies use to build chips. Its original value was designing chips with extremely low energy consumption compared with the X86 chips common in personal computers at the time. It’s seen as something of a neutral party or “Switzerland” in tech, since its designs are used in nearly smartphone processors, including those made by Apple, and increasingly, server and laptop processors as well.

It’s also often considered the crown jewel of the U.K.’s technology sector.

Speaking with CNBC at a developer conference in October 2022, Arm CEO Rene Haas said that companies can’t afford not to work with the company, given its technology is embedded in virtually every device out there.

“Given the fact that we license the technology to all the major players in the industry, no one can really afford to miss a product cycle or scale back on R&D or not do a product,” Haas said at the time.

Arm’s business model is to license the intellectual property for these architectures so that they can build systems around them. In recent years, ARM has tried to sell its own designs for processors, a more lucrative business than just licensing the underlying architecture technology.

SoftBank agreed to acquire Arm in 2016 for $32 billion, which at the time was the biggest-ever purchase of a European technology company. SoftBank at the time said it was acquiring the business to gain a foothold in the growing internet of things sector. IoT, is a small part of the firm’s business, but at the time it was a much-hyped part of tech.

Not just for wearables or smart home appliances, Arm has been expanding its semiconductors to other uses such as connected cars.

For the quarter ended June 30, the company generated 88.5 billion Japanese yen ($605.5 million), according to an earnings release from SoftBank.

But the company is also facing headwinds from a slowdown in demand for products like smartphones, which has hit chip firms across the board. Arm’s net sales fell 4.6% year-on-year in the second quarter.

The unit also swung to a 9.5 billion yen loss, having made a profit of 29.8 billion yen in the same period a year earlier.

Beleaguered sale to Nvidia

SoftBank originally tried to sell Arm to chip giant Nvidia, but the deal faced pushback from regulators, who raised concerns over competition and national security. Nvidia is a behemoth in the world of semiconductors, and the company is now benefiting heavily from the boom in AI applications as demand for its GPUs soars.

Since then, SoftBank has opted to list Arm as an independent company. The Japanese tech investing giant is reportedly looking to purchase the remaining 25% stake in Arm that it does not currently own from its massive $100 billion Vision Fund.

In the U.K., which has sought to boost its domestic chip industry through up to £1 billion ($1.3 billion) in investments, Arm is seen as strategically important.

The change of the company’s ownership to foreign hands is seen as a thorny topic for the domestic tech industry, not least due to concerns that it undermines the U.K.’s “tech sovereignty,” an issue that has cropped up throughout Europe as officials look to reduce dependence on technology from the U.S. and other nations.

The government had pushed aggressively for Arm to list in London, however the company opted to go with New York for its debut instead, dealing a blow to the London stock exchange.

Testing a choppy IPO market

SoftBank is pushing ahead with a listing of Arm even as U.S. markets have been in an unsteady state. Technology valuations have fallen sharply from the peak of the 2021 tech boom.

That year, shares of newly minted public companies such as Palantir and UiPath rose to seismic levels as investors grew excited by their growth prospects in the boom times.

As well as being a bellwether for the chip industry, Arm plays a role in the AI space — and is increasingly touting itself as an AI company. Investors will be watching out for the company’s S-1 filing to see how it sees the technology benefiting its business over time.

In May, Arm unveiled two new chipsets targeted at machine learning applications. One, a new CPU called Cortex-4, is a chipset that delivers faster machine-learning performance and consumes 40% less power than its predecessor, according to Arm. The other, a GPU called G720, offers better performance and uses up 22% less memory bandwidth than its predecessor, Arm said.

“Arm remains committed to developing and testing our GPUs against new applications for machine learning (ML),” the company said in a May 29 blog post announcing the products.

High-powered chips such as those offered by Nvidia and AMD are crucial to AI applications, which require lots of computing power to run smoothly. Earlier this month, Nvidia unveiled its new Grace Hopper chip for generative AI applications, which is based on Arm architecture.

SoftBank is banking on the growth in AI to lift the prospects of its Vision Fund, which has flagged in tandem with souring bets on firms like WeWork, China’s ride-hailing giant Didi Global, and Uber, the latter of which the Vision Fund has since shed its holdings.

SoftBank’s CFO Yoshimitsu Goto said during the company’s June quarter earnings call that the company has been “carefully and slowly emerging back to investment activity,” with a focus on AI investments.

SoftBank said its Vision Fund booked an investment gain of 159.8 billion yen, its first gain in five consecutive quarters. SoftBank said the fund mainly benefited from investments in its own subsidiaries — including Arm.

That still came after SoftBank’s Vision Fund reported a record 4.3 trillion yen loss in the fiscal year ending Mar. 31.

The Japanese tech giant has been starting to talk up its investments in AI recently. In July, the company led a $65 million investment in U.K. insurance technology company Tractable.

– CNBC’s Kif Leswing contributed to this story.

[ad_2]