Cash and cash equivalents are those items on the balance sheet that are liquid assets. Explore the types, accounting practices, and financial impacts of non-cash transactions in this comprehensive guide. The journal entry will debit cost of new car and accumulated depreciation of old car, the credit side is the cost of old car. Nonmonetary Exchange is the process that company exchange its own assets with other assets excluding cash and cash equivalent. It means both companies agree to exchange their assets with each other.

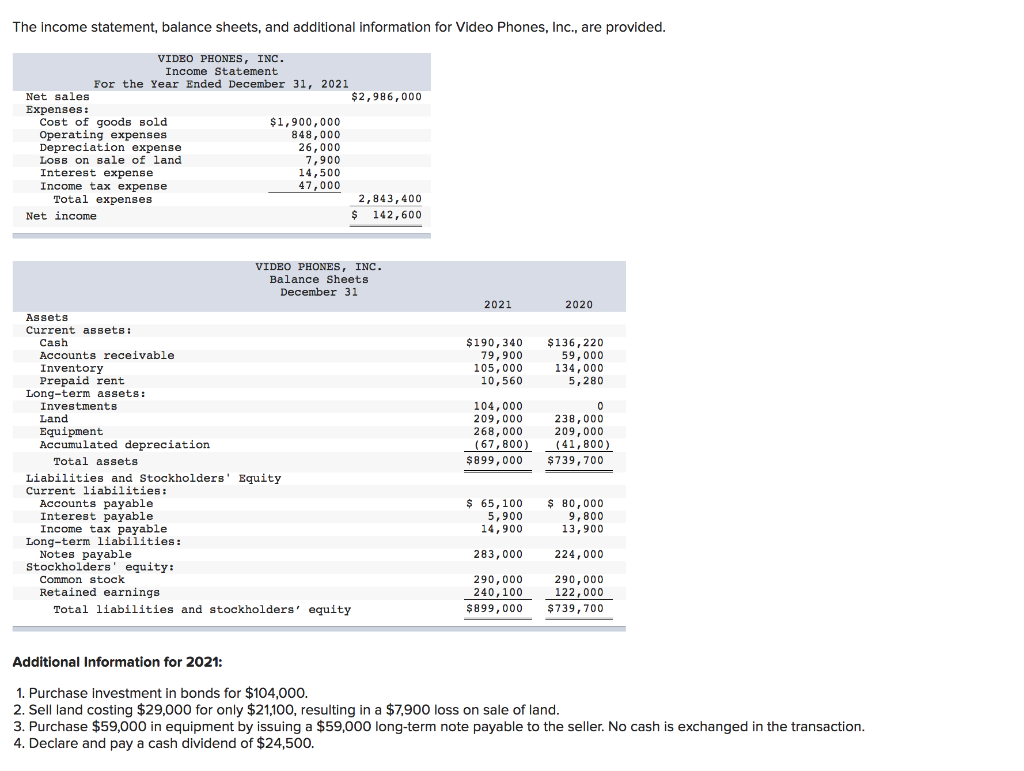

- Given that the transaction didn’t involve cash, it would have no effect on the cash flow statement.

- Non-cash transactions, while not involving the direct exchange of money, can have profound effects on a company’s financial statements.

- Our equity decreased by $140,000 for the expense, but then it also increased by $140,000 for the common stock issued.

Create a Free Account and Ask Any Financial Question

The deficit of $2 per share ($8 minus $10) is called a discount on common stock. For instance, when dealing with barter transactions, companies must assess the fair market value of the goods or services exchanged. This valuation is not always straightforward and may require the use of comparable market data or expert appraisals.

Issuing Common Stock with a Par Value in Exchange for Property or Services

These transactions can range from barter deals to stock-based compensation and the allocation of depreciation and amortization expenses. There are three main types of stock transactions, which are the sale of stock for cash, stock issued in exchange for non-cash assets or services, and the repurchase of stock. We will address the accounting for each of these stock transactions below.

Our Services

A company does not generate any cash inflows or cash outflows from non-cash investing and financing activities. However, these activities can still have a material effect on a company’s financial position. The Walt Disney Company has consistently spent a large portion of its cash flows in buying back its own stock. According to The Motley Fool, the Walt Disney Company bought back 74 million shares in 2016 alone. Read the Motley Fool article and comment on other options that Walt Disney may have had to obtain financing. This entry reflects the expense incurred and the increase in equity through common stock and APIC.

Non Cash Acquisition refers to the process of acquiring businesses or assets by means other than cash. This can involve the exchange of shares, the swapping of assets, and more. If we purchase a new dump truck, we don’t take the entire purchase independent contractor invoice template price as an expense when we purchase it. We put it as an asset on our balance sheet, and then take depreciation expense over the life of the dump truck. A corporation may issue stock in exchange for an operating asset (tangible and intangible).

2 Analyze and Record Transactions for the Issuance and Repurchase of Stock

In practice, the discount on the stock is prohibited in most jurisdictions. This is because the regulators want to protect the creditors of the company who issues the common stock. When issuing at discount, the company is putting its creditors at risk of not being able to repay the debts to creditors. This is because there might not be enough assets to recover the debt owed to creditors in case of default.

Once the fair value is established, the transaction is recorded in the financial statements, ensuring that both the revenue and expense sides of the transaction are accurately represented. This dual-entry system maintains the integrity of the financial records and provides a clear picture of the company’s economic activities. Barter transactions involve the direct exchange of goods or services between parties without the use of cash. This ancient practice has found modern applications, particularly in industries where liquidity is tight or where companies seek to leverage excess inventory. For instance, a software company might exchange its products for marketing services from another firm.

The complexity of stock-based compensation lies in estimating the fair value, which often involves sophisticated models like the Black-Scholes option pricing model. This method not only incentivizes employees but also conserves cash, making it an attractive option for growing companies. When a company issues stock for property or services, the company increases the respective asset account with a debit and the respective equity accounts with credits.

So if we hadn’t paid him in common stock, we would have had to pay him in cash of $140,000. We receive these legal services, and we’re going to assume that we already used the legal services, right? The common stock just like before, we’re going to have the same entry, right? Now, instead of having cash or building in our debit, we have legal expense, but our credits are still common stock and APIC just like we’re used to, right?

The structure of a journal entry for the cash sale of stock depends upon the existence and size of any par value. Par value is the legal capital per share, and is printed on the face of the stock certificate. The contra account of common stock is presented as a reduction of par value stock in the balance sheet. Theoretically, common stock can be issued at par value, no par value, at stated value, or for non-cash assets.

While this approach provides a straightforward valuation, it may not fully capture the market dynamics or the income potential of the asset. It is most effective when applied to assets with readily ascertainable costs and limited variability in replacement expenses. Sometimes a corporation decides to purchase its own stock in the market. A company might purchase its own outstanding stock for a number of possible reasons.