This enables project managers to improve future project planning, enhance evaluation techniques, and optimize implementation strategies based on actual experience. This enables better planning for resource needs, helps prevent cash flow shortages, and ensures what is capex and opex projects maintain adequate funding throughout implementation phases. This helps project managers make informed choices about resource allocation, timeline adjustments, and scope changes while maintaining focus on achieving optimal project outcomes.

Identify Potential Opportunities

- Prepare cash-flow estimates that start with projected revenues and deduct operating expenses, including loan payments.

- While not all projects are capital in nature, and not all capital investments are project-based, project portfolio management and capital budgeting are deeply entwined.

- Throughput methods often analyze revenue and expenses across an entire organization, not just for specific projects.

- The cash flows at the earlier stages are better than the ones coming in at later stages.

We’ll consider the challenges and risks inherent in current processes and make the case for digital transformation of the capital budgeting process — in turn, helping to eliminate waste and maximize your returns. Inflation affects project costs, revenue projections, and discount rates, requiring organizations to adjust cash flow estimates and use real rather than nominal values in calculations. Organizations should conduct quarterly reviews of ongoing projects and annual comprehensive evaluations of the entire capital budgeting process to ensure effectiveness and identify necessary improvements. Research and development investments are evaluated through capital budgeting by analyzing potential returns against uncertain outcomes.

Get in Touch With a Financial Advisor

Project evaluation must incorporate feedback from senior management and investor expectations. This includes assessing alignment with management vision, risk tolerance levels, and return expectations of key stakeholders. Organizations must evaluate how technological developments might impact project viability and returns. This includes assessing potential disruptions, opportunities for efficiency improvements, and needs for technological integration or upgrades. Projects must support and advance the organization’s strategic vision and mission. Evaluation criteria should include how well investments align with long-term growth plans, market positioning, and overall business strategy.

Risk assessment tools quantify uncertainties

Use the NPV method to determine if future revenues less expenses, when discounted to the present, will exceed the initial investment outlay. That will be the decision point for a viable project, when NPV is greater than zero. A manager must evaluate the project in terms of costs and benefits if certain investment possibilities may not be beneficial. This evaluation is done based on the incremental cash flows from a project, opportunity costs of undertaking the project, timing of cash flows, and financing costs.

Use data-driven insights to identify variances and potential issues early in the implementation process. This systematic approach combines quantitative analysis with qualitative factors, ensuring a balanced perspective that considers both financial returns and strategic implications. Prepare several “what-if” projections to find the effects on cash flow if the actual results are less than needed to justify the investment. These methods are used to evaluate the worth of an investment project depending on the accounting information available from a company’s books of accounts.

Since a capital budget can span many quarters or even many years, organizations can use DCF to not just asses the timing of cash flow but also the implications of the dollar. Your capital budgeting software should combine both new and in-progress initiatives for holistic analysis. To effectively compare the business cases for alternative investment proposals, you should standardize the project evaluation, scoring and ranking methodology. Ensure that any metrics (such as Payback Period) are calculated consistently, and provide a clear and transparent basis for project scoring. Such measures help to expedite and ensure the effectiveness of project prioritization. Not only is this a direct cost to the organization, but the key risk is that so much time is spent administering the process, that insufficient time is invested in ideation or in deeper evaluation of initiatives.

Since there is no ‘one-size-fits-all’ factor, there is no defined technique for selecting a project. Every business has diverse requirements and therefore, the approval over a project comes based on the objectives of the organization. It mainly consists of selecting all criteria necessary for judging the need for a proposal. Assuming the values given in the table, we shall calculate the profitability index for a discount rate of 10%. Thus, the process is complex, consisting of the various steps required to be followed strictly before finalizing the project. A positive NPV on a base case projection indicates that the project is worth pursuing.

Despite the need for the capital budgeting system to offer sophisticated portfolio recommendations, responsibility should remain with area managers to optimize their capital budget allocation. Only area managers have the experience and judgment to fine-tune portfolio selections. Accordingly, potential investments could be evaluated simply on the basis of financial return. Corporations are now also expected to meet Environment, Social and Governance (ESG) targets. Financial ratios help evaluate project viability by measuring profitability, efficiency, and risk metrics, providing standardized benchmarks for comparing different investment opportunities against set criteria.

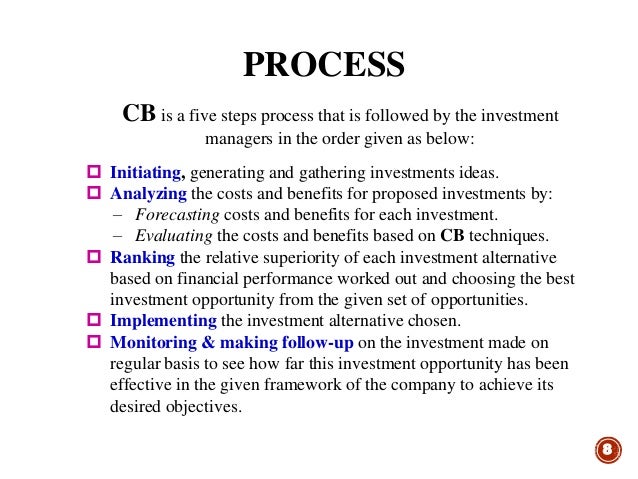

One way to arrive at this figure is to review data on similar projects that have proved successful in the past. Identify and evaluate potential opportunitiesThe process begins by exploring available opportunities. For any given initiative, a company will probably have multiple options to consider. For example, if a company is seeking to expand its warehousing facilities, it might choose between adding on to its current building or purchasing a larger space in a new location. As such, each option must be evaluated to see what makes the most financial and logistical sense. Once the most feasible opportunity is identified, a company should determine the right time to pursue it, keeping in mind factors such as business need and upfront costs.