[ad_1]

Timothee Chalamet stars in Warner Bros.’ “Dune.”

Warner Bros.

LOS ANGELES – Warner Bros. has a sandworm-sized dilemma on its hands: Keep the fall release date for its highly anticipated “Dune: Part Two” and risk not having its star-studded cast promote it – or bump it into next year and potentially miss out on a dominant run at lucrative premium movie screens.

As two Hollywood strikes rage on, movie writers and stars aren’t permitted to hype their projects, due to strike rules. The longer the work stoppages keep going, the more likely it is studios will delay releases as production shutdowns choke the movie release pipeline.

Already, a handful of titles – including Ethan Coen’s “Drive Away Dolls,” the sequel to “Ghostbusters: Afterlife” and the Emma Stone-led “Poor Things” – have moved to later dates due to the labor disruption. “Dune: Part Two,” a science fiction epic based on Frank Herbert’s seminal novel, could end up the biggest title to move. Speculation has swirled about the sequel leaving its Nov. 3 slot since the Screen Actors Guild-American Federation of Television and Radio Artists went on strike last month.

After the stunning success of “Barbie,” and with doubts growing about December’s “Aquaman: The Lost Kingdom,” “Dune: Part Two” would be a important 2023 release for Warner Bros. Its predecessor excelled at the box office during the pandemic despite being released day and date on streaming service HBO Max (now just called Max). It racked up 10 Academy Award nominations, taking home six trophies.

With pandemic restrictions lifted on movie theaters, expectations are that “Dune: Part Two” would outpace the nearly $400 million the prior film tallied at the global box office in 2021 on a reported budget of $165 million.

“As one of the biggest and most anticipated movies of the all-important and prestigious holiday season, ‘Dune: Part Two’ is one of the crown jewels of Warner Bros.’ end of year lineup and has much riding on its cinematic shoulders,” said Paul Dergarabedian, senior media analyst at Comscore.

Warner Bros. didn’t immediately respond to CNBC’s request for comment.

While the Writers Guild of America has returned to the bargaining table with producers, negotiations are moving slowly.

Meanwhile, the producers haven’t contacted the other striking guild, SAG-AFTRA, to resume talks. SAG-AFTRA has also promised not to grant interim agreements to any WGA-covered productions produced in the U.S., meaning these projects cannot start or continue filming or be promoted by active guild members if they are released.

There’s genuine fear that the labor fight will drag on, as well.

“I think it’s gonna go into next year,” said Steven Schiffman, an adjunct professor at Georgetown University and a former executive at National Geographic. “I think it’s gonna get to a really painful process.”

To ‘Dune’ or not to ‘Dune’

The inability to have actors promote film releases is one of the major headwinds facing “Dune: Part Two.”

Typically, studios will begin marketing their films in earnest, beyond trailers and posters, in the six to eight weeks leading up to a film’s release. These efforts often include late night talk show appearances by cast members, taped interviews and junkets, as well as international promotional trips.

If SAG-AFTRA does not reach a deal by the middle of September, the marketing campaign for the sequel won’t be able to utilize its star-studded ensamble to promote the film.

Alongside industry veterans like Christopher Walken, Stellan Skarsgard, Javier Bardem, Josh Brolin, Dave Bautista and Jason Momoa, the film features four of Hollywood’s most popular young stars.

Zendaya, Timothee Chalamet, Florence Pugh and Austin Butler collectively have more than 200 million followers on Instagram and are trending faces on TikTok, Twitter and other social media platforms.

“Without that, they forgo a huge chunk of Gen Z going to see that movie,” said Alicia Reese, vice president of equity research at Wedbush Securities.

She noted that older moviegoers who are fans of the book and saw the first “Dune” will show up to theaters, but younger audiences might miss out on the flick without promotion from these stars.

“Missing out on that, that’s damaging,” Reese said, “But is it damaging enough to not show the movie at all? Because if they move it, they risk losing that really prime IMAX spot.”

In 2022, 15% of all domestic tickets sold were for premium screenings, with the average ticket costing $15.92, according to EntTelligence data. A standard ticket costs an average of $11.29.

If “Dune: Part Two” moves into next year, it runs the risk of not finding a weekend, or multiple weekends, where it will be able to capture a significant portion of premium screens or not be able to hold them for several weeks of its run.

Additionally, if it holds to its current date, other films could move and it could find itself with limited competition and the ability to capture more audience attention.

“Every studio with a film on the calendar is confronting how to deal with similar such dilemmas,” said Dergarabedian.

Yet to come in 2023 are Disney and Marvel’s “The Marvels,” Lionsgate’s “The Hunger Games: The Ballad of Songbirds & Snakes,” Disney Animation’s “Wish,” AppleTV+’s “Napoleon.” Warner Bros. has other big titles, too: “Wonka,” the “Aquaman” sequel and “The Color Purple.”

“There are practical arguments in support of ‘Dune: Part Two’ both moving and staying put,” said Shawn Robbins, chief analyst at BoxOffice.com. “For the health of the industry overall, I think the scales still tip in favor of remaining in November.”

While “Barbie” and Universal’s “Oppenheimer” have injected nearly a billion dollars into the domestic box office’s coffers in the last month, there are few blockbuster releases slated for the remainder of the year, the “Dune” sequel among them.

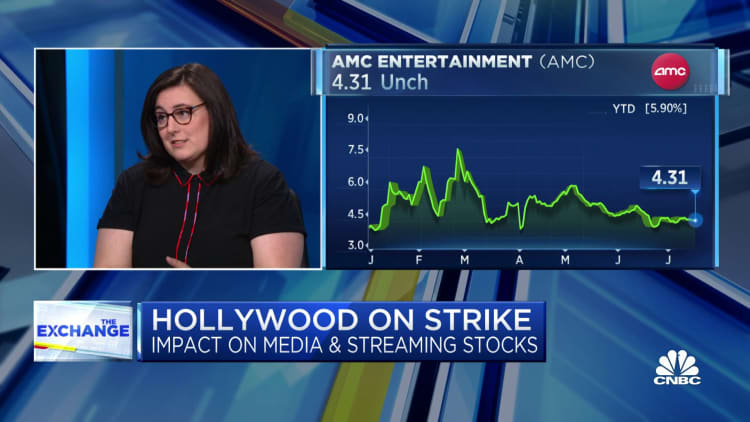

A depleted fourth-quarter movie slate could hurt exhibition partners like AMC, Cinemark and Regal that are heavily reliant on new content.

Moving “Dune: Part Two” could possibly provoke other studios to delay big releases until next year, according to Robbins.

“Frankly, the back half of this year doesn’t need anymore of a challenge trying to live up to the strong spring and summer we’ve seen at the box office,” he said.

Disclosure: Comcast is the parent company of NBCUniversal and CNBC.

[ad_2]