[ad_1]

Two people hold two Shein bags after entering SHEIN’s first physical store in Madrid, Spain, June 2, 2022.

Cezaro De Luca | Europa Press | Getty Images

Chinese fast fashion giant Shein on Friday denied a Reuters report that said it has confidentially filed for an initial public offering in the U.S.

“Shein denies these rumors,” a Shein spokesperson told CNBC.

Reuters, citing sources familiar with the matter, reported the listing could happen before the end of the year.

Founded in 2012 by Chris Xu, the brand rose to global prominence for its budget-friendly and trendy apparel. Shein was recently valued at $64 billion, according to Reuters.

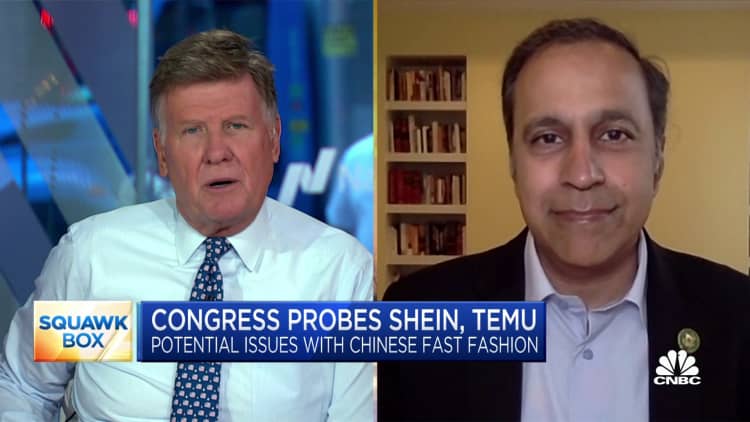

But Shein, as well as Pinduoduo’s budget e-commerce app Temu, have been accused of exploiting trade loopholes to import goods into the U.S. without paying duties or making shipments subject to human rights reviews, according to a report from a U.S. House committee.

Shein told CNBC last week its policy is to “comply with the customs and import laws of the countries in which we operate” and that it will continue to “make import compliance a priority.”

Reuters noted the listing could make Shein the most valuable Chinese company to go public in the U.S. since Didi Global.

In 2021, the ride-hailing giant listed on the New York stock exchange at a $68 billion valuation, but de-listed less than 6 months later due to pressure and data security concerns from Chinese regulators.

In May, U.S. lawmakers urged the SEC to crack down on Shein for allegedly selling clothes made by forced labor in Xinjiang, China.

“We have zero tolerance for forced labor,” a Shein spokesperson had told CNBC in May.

Shein recently hosted a group of influencers at its facilities in Guangzhou, China. While the influencers posted videos praising the company, dismissing allegations of forced labor, many viewers criticized the creators for repeating “propaganda.”

— CNBC’s Penny Chen contributed to this report.

[ad_2]