[ad_1]

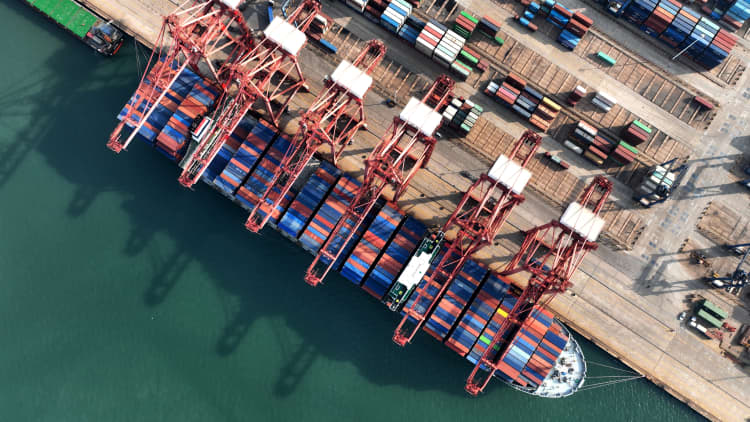

Cargo ships dock at the container terminal in Lianyungang Port, East China’s Jiangsu province, Dec 7, 2022.

CFOTO | Future Publishing | Getty Images

The Covid hangover of inventories continues to be a big headache for retailers and the logistics companies which make money moving their products. As peak retail trade order season nears — July is the official start of the back-to-school and holiday order inventory build that runs through October — executives in the shipping industry are keeping a watchful eye on order activity.

Holiday orders are traditionally imported starting in August, with the manufacturing orders for these items made by retailers as much as six months in advance. During that timeframe this year, the U.S. consumer was facing record inflation and retail discretionary spending behavior was defined by a more discerning shopper.

Inflation is coming down for, among other reasons, the Federal Reserve rate hikes cooling the economy, but there is concern within the logistics industry that interest rate policy kills too much demand. In the notes from the most recent Fed meeting released on Wednesday, there was division among central bank officials on whether a pause in hikes was merited at its decision in June, but there was a tilt in the minutes towards pausing.

“If the Fed moves forward with another couple of rate hikes notwithstanding the progress we’re seeing with disinflation and cooling inflation, that could have a real negative impact as it relates on demand,” said James Gagne, SEKO Logistics CEO.

Still, category by category, demand levels vary. Gagne said cosmetics, for example, looks to be in much better shape than home improvement.

“I think it’s really hard to imagine in the near term given how much work Americans have done on what we call home improvement projects in the last 24 to 36 months and then potentially given where interest rates might still go, we see a resurgence in the home improvement category,” he said.

Home Depot’s recent quarterly released last week showed its first earnings miss since May 2020 and its biggest revenue miss since November 2002 with the company citing “broad-based pressure across the business,” as well as “further softening of demand relative to our expectations, and continued uncertainty regarding consumer demand.”

SEKO executives said they are seeing consumers trade down in the product, but as far as which categories will be the big winners this peak season, it’s too soon to know.

“The pig in the python has yet to go through when it relates to inventory” said Hans Hickler, president of Americas for SEKO Logistics.

How sticky inflation will influence holiday shopping

Wall Street CEOs don’t expect inflation to dramatically decline, even if the Fed now has it under control. In recent comments, JP Morgan Chase CEO Jamie Dimon has said to expect Fed rate hikes to reach as high as 6% to 7% and Goldman Sachs CEO David Solomon said he expects inflation to be “stickier and more resilient.”

“If we foresee that inflation stays high and we have uncertainties, people are going to spend less and that impacts the overall absolute numbers and it’s probably going to be a lower peak season,” said Tim Scharwath, CEO of DHL Global Forwarding. But he added that even if peak season is lower this year, there is still a chance it can be better than 2022, though that’s not a high bar to clear.

“It would be good if this year’s peak season could be a bit better than ’22 considering there was no peak last year,” Scharwath said. “So when the comparisons come in for the second half of the year and the numbers go up even a little and they cross that line over 2022, I think we’ll all be happy.”

A peak season rebound would be a boost to earnings of logistics companies.

Both DHL And SEKO Logistics tell CNBC they have not seen “peak season” bookings in the June or July data but they are cautiously optimistic for the second half of the year. Even though the traditional peak season starts in August, holiday orders can start arriving in June and July.

“The first half of the year has been muted,” Gagne said. “Each industry will see a different restocking event. Some companies are burning through inventory others are not. It all depends on the commodities. Consumers are spending on experiences.”

Hickler said SEKO is closely watching the timing of orders.

“We are paying attention to see if there is a situation where everyone waits until the last minute to get their products on the shelves for the holidays and that could be another challenge,” Hickler said. “But we don’t see that happening yet. But it’s certainly something we’re watching.”

If orders did start to come in later and in bunches, that could create a container surge and supply chain delays.

Positive signals from back-to-school orders

Alan Baer, CEO of OL USA, says that while the market and logistics industry want a return to normalcy in the supply chain, a traditional peak season may be skipped this year and not return until the third quarter of 2024.

“The compounding effect of economic uncertainty, tightening credit standards, and inventory overhang will lead to a muted, if any, peak season in the TransPacific Eastbound trade,” Baer said. “Volumes for now have ticked higher, however, until companies see stronger engagement from consumers, the future ordering pattern will remain under-trend for the balance of 2023.”

Similar to commentary from DHL, RXO is expecting a stronger peak season this year because there was no peak season last year. “I think holiday volumes will be more in line, in 2018, 2019, maybe slightly behind that,” Wilkerson said.

He added that back-to-school orders can provide a read on the consumer expectations among retailers ahead of the holidays, and so far, that’s sending a positive signal.

“Our discussions with clients for back-to-school are going on now,” Wilkerson said. “We are seeing a lot of apparel, and other back-to-school items orders either on par to slightly up compared to last year. Last year it was up because more kids were going back to school in person.”

[ad_2]