[ad_1]

A Facebook sign is seen at the second China International Import Expo (CIIE) in Shanghai, China November 6, 2019.

Aly Song | Reuters

Meta may be banned from operating in China, but the company is finding plenty of growth coming from the world’s second-biggest economy.

In its third-quarter earnings report on Wednesday, Meta said sales rose 23% from a year earlier, illustrating the company’s ability to weather a tough digital ad market better than smaller rivals like Snap and X, formerly known as Twitter.

Susan Li, Meta’s finance chief, told analysts on the earnings call that Chinese companies played a major role this quarter, continuing a theme from recent periods.

Online commerce and gaming “benefited from spend among advertisers in China reaching customers in other markets,” Li said. That means Chinese companies are spending big money on Meta’s platforms like Facebook and Instagram to send targeted advertising to the company’s billions of users around the world.

Among Meta’s geographic regions, Li said the rest of the world category showed the strongest growth, at 36%. Europe was next at 35%, followed by Asia-Pacific at 19% and North America at 17%. The first category includes South America, and Li said China was a big reason for the rapid expansion.

“Brazil was a strong contributor to the region’s acceleration due in part to increased advertisers demand from China advertisers targeting users in Brazil,” Li said.

Facebook, along with Google and Twitter, are all blocked in China due to the country’s Great Firewall. Facebook and its sibling apps have been inaccessible there since 2009.

Still, Meta has witnessed a “longer-term trend of overall growth” from the China market, Li said, though there have been some “periods of volatility.” For instance, she said that the past two years were marred by higher shipping costs that resulted from the Covid pandemic, which also brought strict lockdown rules in China.

But with China opening up more this year and the worldwide supply chain problems easing, Chinese companies are looking to expand their businesses around the globe and are using Meta as a major tool.

Ultimately, “spending from Chinese advertisers further accelerated for us in Q3,” Li said, adding that “lower shipping costs and easing regulations on the gaming industry have served as tailwinds here.”

Li stressed “the potential for volatility in the future” particularly because “there are so many macro factors at play that are quite hard to predict.”

In particular, Li cited the unpredictability in the Middle East due to the Israel-Hamas war, which led Meta to widen its revenue guidance range.

“We have observed softer ads in the beginning of the fourth quarter, correlating with the start of the conflict, which is captured in our Q4 revenue outlook,” Li said. “It’s hard for us to attribute demand softness directly to any specific geopolitical event.”

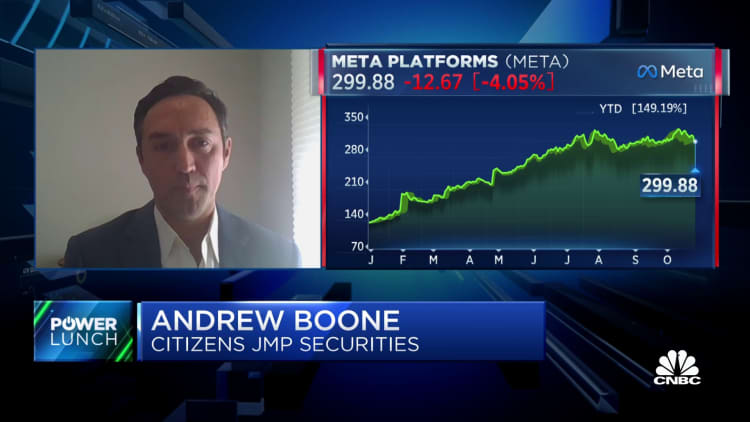

Meta shares dropped more than 3% in extended trading, wiping out earlier gains, after Li’s cautionary comments.

Watch: Big tech earnings, AI usage and growth under scrutiny

[ad_2]